Data analysis shows that the Goods and Services Tax (GST) has significantly increased revenue for both the central and state governments.

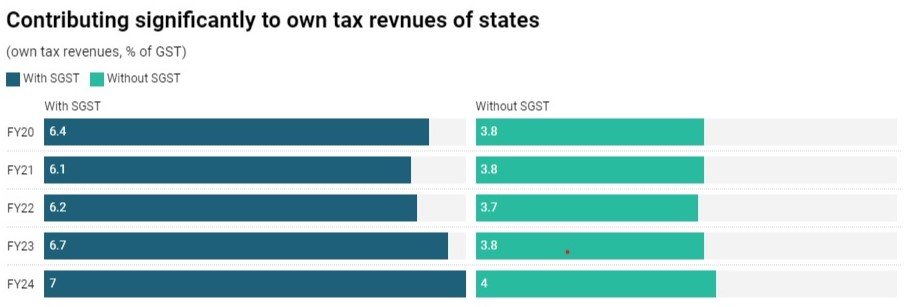

Since its implementation, states have seen nearly a 3 percentage point increase in their own tax revenue ratio compared to the pre-GST era.

Experts suggest that the next phase of GST, or GST 2.0, should focus on rate rationalization and removing input tax credit restrictions.

Celebrating seven years on Monday, the GST regime has standardized most tax rates nationwide and boosted tax revenues.

Monthly collections have doubled, averaging over Rs 1.8 lakh crore in the past three months, compared to Rs 89,884 crore in its first year.

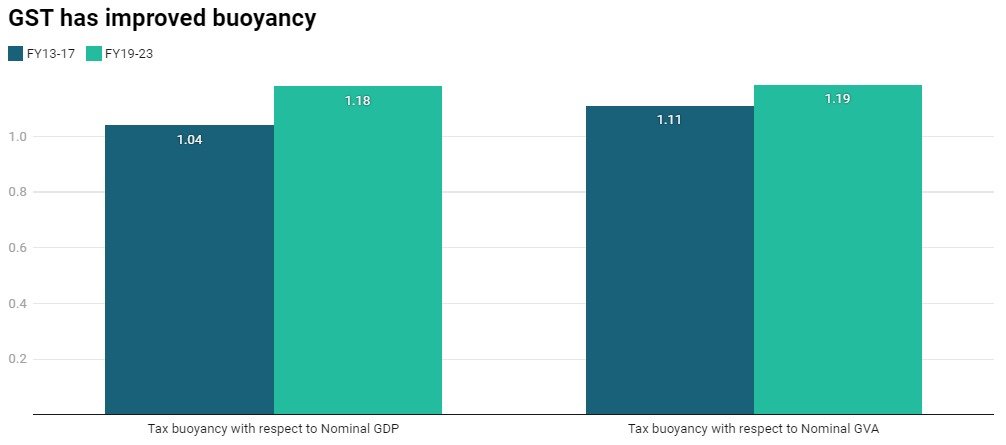

A National Institute of Public Finance and Policy (NIPFP) paper from April last year noted that GST buoyancy since its launch on July 1, 2017, has been higher than in the five years before.

Additionally, an RBI study on state finances highlighted that robust growth in State GST (SGST) has reduced the fiscal imbalance between the Centre and the states.

State tax revenue collections jumped to 65.4% of total tax revenues in FY22 and FY23, up from the pre-GST average of 62.8% in FY16 and FY17.

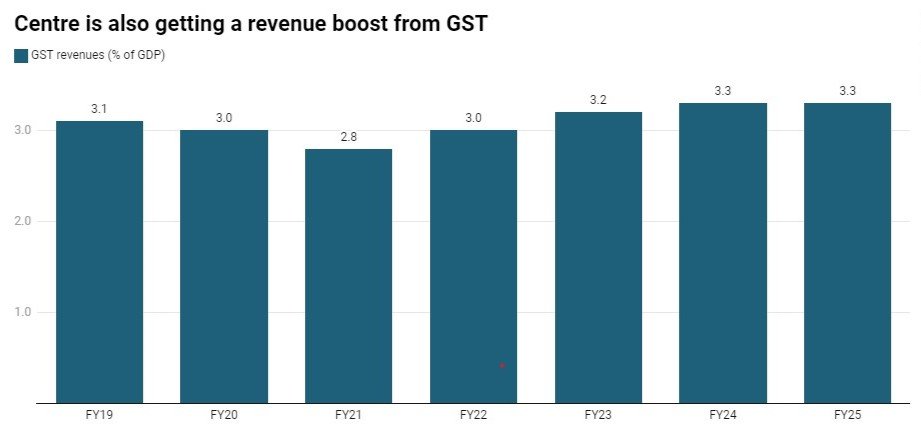

The Centre's GST revenue share of GDP increased to 3.3% in FY24 from 3.1% in FY19.

Experts believe that the increased revenue collections pave the way for the next phase of GST reforms.

Mahesh Jaising, Partner at Deloitte India, suggested that these reforms could include easing the impact on working capital, rationalizing GST rates, removing input tax credit restrictions, and implementing sector-specific reforms.

Jaising also noted that industry stakeholders are looking forward to more streamlined GST audits and investigations as the statute of limitations for the initial years nears its end.

Request a call back

Request a call back