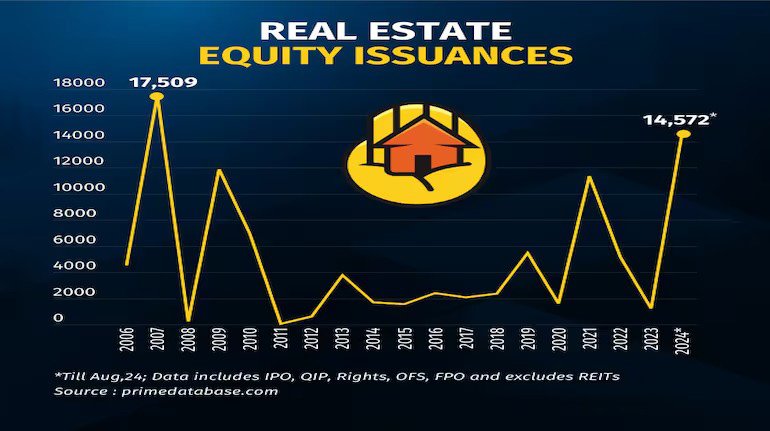

The real estate sector is experiencing its highest equity fundraising in 17 years, largely driven by Qualified Institutional Placements (QIPs), which reached an all-time high of ₹11,746 crore in 2024. This year marks the second-best for overall equity issuances since 2007, with real estate companies raising ₹14,572 crore through IPOs and QIPs by August 2024, according to Prime Database.

In 2007, equity issuances hit ₹17,509 crore. These figures account for IPOs, QIPs, FPOs, rights issues, and OFS but exclude fundraising by REITs, which have only recently emerged.

The QIP route has been a major contributor to this fundraising surge, with Prestige Estate Products raising ₹5,000 crore and Macrotech Developers securing ₹3,282 crore through this channel. Vikas Khattar, MD at Ambit, noted that the sector raised over ₹10,000 crore this year, and expects further activity over the next 6-12 months, with several developers announcing plans for QIP-based fundraising and potential IPOs.

This surge reflects a post-pandemic revival in the real estate sector, fueled by strong residential sales, improved commercial leasing, and higher average daily rates in the hospitality sector. This has led to enhanced growth and profitability, prompting companies to raise funds for future expansion as existing land inventories shrink.

The trend towards equity fundraising marks a shift from the sector's previous reliance on debt-driven growth. Initially, real estate developers remained cautious after the Covid boom, unsure if the demand surge would last. However, sustained demand has made developers confident in tapping equity markets for capital.

Equity is now seen as a more sustainable, patient form of capital compared to debt, which is crucial for maintaining momentum and funding growth through land acquisitions. While QIPs dominate the fundraising landscape, there is also increasing interest in IPOs, particularly from related sectors like hospitality and co-working spaces. Awfis' IPO earlier in the year indicated strong demand in the co-working space, with several more IPOs expected in this sector within the next year.

The hospitality sector has also seen notable activity, with IPOs from companies like SAMHI and Juniper, reflecting rising post-pandemic travel demand in India. Experts caution that rising real estate prices in some markets, timely project execution, and financial discipline are key factors investors should monitor. Sharp price increases could dampen sales and impact overall valuations. Additionally, developers need to ensure that they can scale up project execution to match the rising volume of work. Failure to do so could result in delays and a loss of consumer confidence.

Request a call back

Request a call back