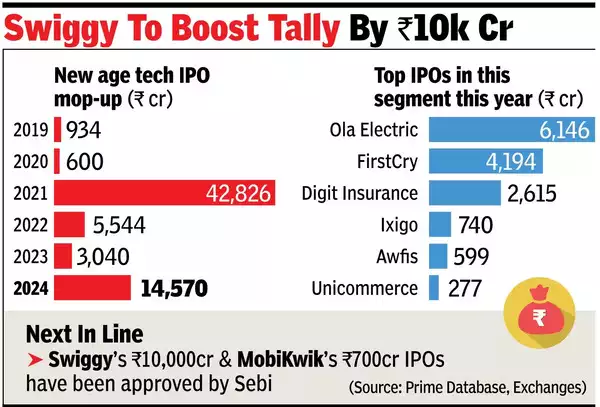

MUMBAI: New-age tech IPOs are benefiting from a strong stock market rebound after nearly three years of inactivity. So far, they have raised close to Rs 15,000 crore this year, marking it the most successful for IPO fundraising since 2021, which saw major listings from startups like Paytm, Zomato, and Nykaa.

Six tech startups, including Ola Electric and FirstCry, have collectively raised Rs 14,571 crore in 2024, as per Prime Database and exchange figures. In comparison, seven startups raised Rs 42,826 crore through IPOs in 2021.

Swiggy and MobiKwik, whose IPO filings have been recently approved by SEBI, are also expected to go public soon. Swiggy's IPO, initially valued at Rs 10,000 crore, is expected to increase to Rs 11,700 crore, making it the second-largest startup IPO since Paytm's Rs 18,300-crore listing in 2021. Companies like Blackbuck and Ather Energy have also filed draft papers as they seek to capitalize on favorable market conditions. Since 2019, around 21 new-age tech firms have raised a total of Rs 67,515 crore through IPOs.

According to Neha Agarwal, MD and head of equity capital markets at JM Financial Institutional Securities, tech IPOs could account for 20-30% of the estimated $15-20 billion IPOs expected in the second half of FY25. In the first half, the market saw $7 billion worth of IPOs.

Agarwal noted that many startups listed in 2021 are now showing operating profitability, easing concerns about their long-term business models. After a three-year slowdown caused by the global tech downturn, which led companies like Snapdeal and Oyo to withdraw IPO plans, tech companies are now reviving public listing efforts. Data shows only five companies went public between 2022 and 2023.

Gaurav Sood, MD at Avendus Capital, predicts that $75-100 billion in tech market cap will be added to public markets in the next three years, with domestic asset managers increasing their stakes in these companies. Startups like Zepto and PhysicsWallah are also preparing to go public as the secondary market continues to surge, according to Pranav Haldea, MD at Prime Database Group.

Request a call back

Request a call back