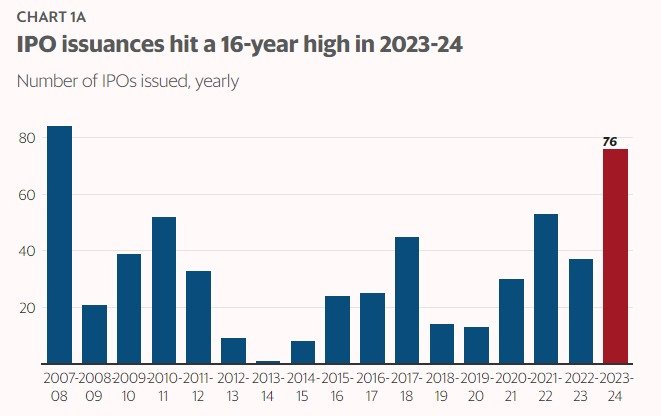

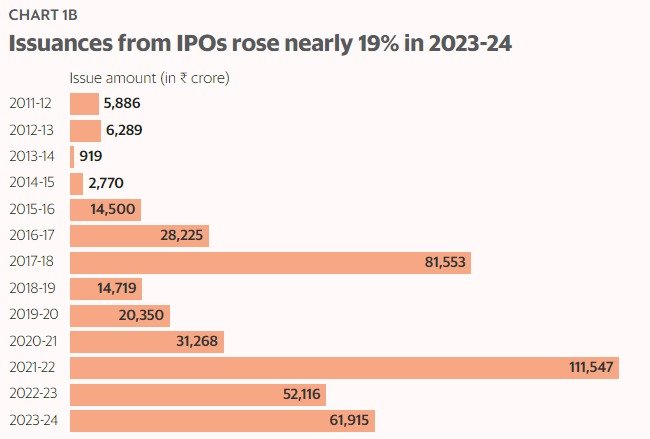

A buoyant market sentiment encouraged a whopping 76 companies to tap into the public markets in the fiscal year 2023-24, the highest in 16 years. Collectively, these companies raised ₹61,915 crore, a near 19% increase over the previous year, according to data from primedatabase.com. The growth was even better after excluding the mega initial public offering (IPO) of Life Insurance of India Corp, which came out in 2022-23: excluding it, the money raised almost doubled, rising 96%.

In 2022-23, a total of 37 IPOs had raised ₹52,116 crore. Excluding LIC’s fundraising, this figure was ₹31,559 crore.

During the just concluded fiscal year, September, December, and February emerged as the peak months for IPO activity, with the capital markets witnessing 14, 11, and 11 public offerings, respectively.

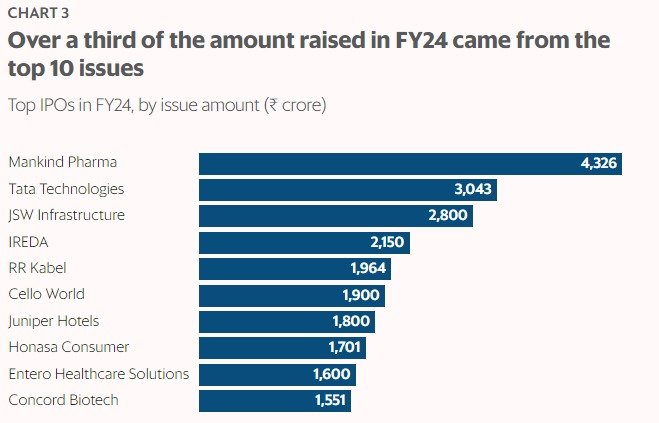

The largest IPO in 2023-24 was from Mankind Pharma ( ₹4,326 crore). This was followed by Tata Technologies ( ₹3,043 crore) and JSW Infrastructure ( ₹2,800 crore). The average deal size reduced significantly to ₹815 crore in comparison to ₹1,409 crore in 2022-23 and ₹2,105 crore in 2021-22.

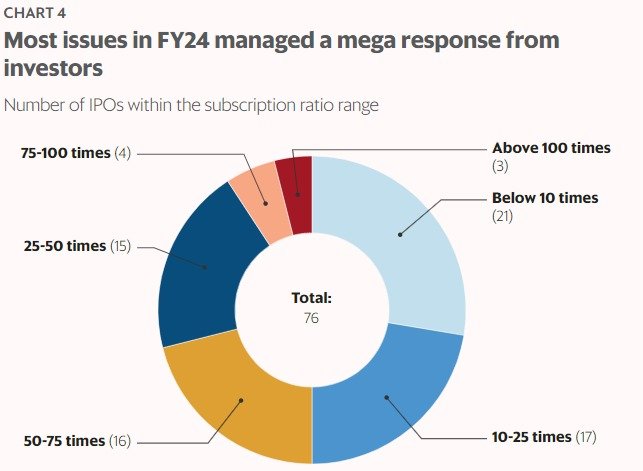

The issues in 2023-24 garnered a huge response from the investors, with most issues being oversubscribed by more than 10 times. Around 30% of the issued were subscribed by over 50 times and another 20% were subscribed between 25 and 50 times.

Request a call back

Request a call back