Several investment holding companies (IHCs) experienced a rally on Friday, outperforming the broader market, following Sebi's announcement of a special call auction session aimed at fair price discovery. These entities, known as Holdcos, hold assets and securities of other listed companies, typically their own group firms.

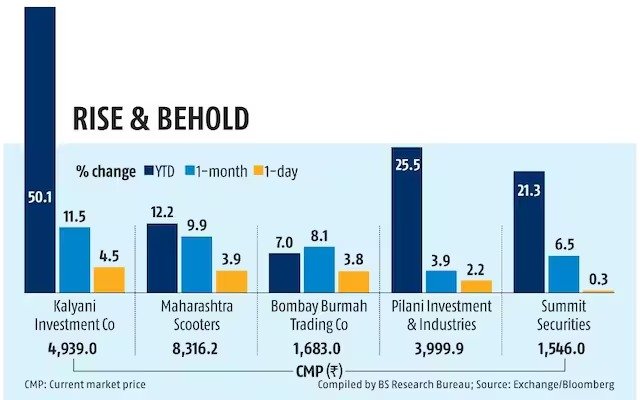

Shares of the Bombay Burmah Trading Corporation, a Wadia group holding company, rose 3.8% to Rs 1,683. Similarly, Kalyani Group’s Kalyani Investment Company saw a 4.5% increase, closing at Rs 4,939.

Other holding companies like Pilani Investment, Maharashtra Scooters, and Summit Securities also ended the day positively despite the volatile market.

Analysts note that these stocks often trade at significant discounts to their book values and holdings. Investors are hopeful that the special auction will allow them to sell these shares at much higher prices.

Globally, Holdco discounts are typically 30-40%, but in India, they are around 70% due to high dividend taxes and legacy issues. Whether a single price discovery session can unlock this value remains to be seen.

On Thursday, Sebi announced a special call auction with no price bands to aid in the price discovery of holding companies, with the first session set for October. Price bands, or circuit filters, are the daily trading limits for stocks.

The exchanges will provide a 14-day notice before the auction, detailing book values and the latest buyback prices. This session will be held annually.

To qualify for the special session, holding companies must have at least 50% of their assets invested in other listed companies, and their six-month volume weighted average price (VWAP) must be less than 50% of the book value per share. Additionally, the book value based on listed investments must be at least Rs 10 crore, and the total issued shares must be 10 million.

The auction will be deemed successful if orders come from at least five unique buyers and sellers. If not, it will be extended until price discovery is achieved.

This year, holding companies have rallied since Sebi first proposed this price discovery method, with gains further supported by the strong performance of underlying companies' shares.

Request a call back

Request a call back