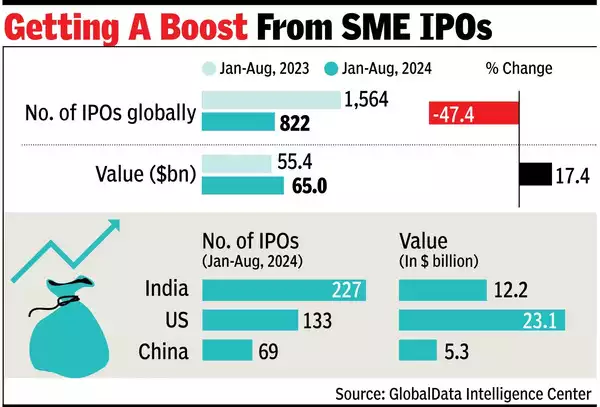

MUMBAI: India led the global IPO market with 227 listings, raising 1,02,136.631 crore in the first eight months of 2024, driven by strong market conditions, a stable macroeconomic environment, and increased investor interest, as reported by GlobalData. The Asia-Pacific region saw 575 IPOs totaling 1,98,412.9635 crore, while North America recorded 149 IPOs worth 2,12,645.117 crore.

India's dominance was largely due to a surge in SME IPOs, securing 227 deals valued at 1,02,136.631 crore The US ranked second with 133 IPOs raising 1,93,389.8505 crore, and China followed with 69 IPOs worth 44,370.8315 crore. Both India's SME and mainboard IPO segments contributed to the rise, fueled by strong demand from retail and institutional investors.

Despite a decline in the number of IPOs globally in 2024, the overall deal value rose, with 822 IPOs generating 5,44,170.575 crore, a 17.4% increase from the 4,63,800.767 crore raised by 1,564 listings in the same period of 2023. This suggests a trend toward fewer but larger IPOs, Global Data noted.

Murthy Grandhi, an analyst at Global Data, said the resurgence in private equity and venture capital-backed listings and improving investor sentiment towards equities fueled the IPO market's recovery in 2024. Technology and communications led with 135 IPOs worth 53,579.872 crore, followed by financial services with 113 deals raising 97,113.518 crore, construction with 79 IPOs totaling 32,650.2345 crore, and pharmaceuticals and healthcare with 75 deals raising 58,602.985 crore.

Grandhi added that the IPO market's future trajectory would be shaped by factors like monetary policy, geopolitical changes, and shifting investor preferences. Businesses with strong financial performance and long-term growth prospects will stand out to investors in this evolving environment.

Request a call back

Request a call back