Passenger car major Hyundai Motor Company’s plan to list its domestic arm may prompt more multinational companies (MNCs) to consider listing their India arms.

Investment banking sources said they were in early-stage talks with about half a dozen MNC firms, which are exploring options to list in India to unlock value and help the parent company raise capital. Without divulging any names, they said the road map followed by the Seoul-based automobile major is keenly eyed by other MNCs.

“Talks are ongoing in the background with other MNCs. The Indian markets offer high valuations, robust liquidity, and access to all kinds of investors. The Hyundai listing will be seen as a litmus test for other potential initial public offerings (IPOs) of other MNC arms,” said an investment banker handling the Hyundai listing, requesting anonymity.

Last week, Hyundai filed the offer document with market regulator Securities and Exchange Board of India (Sebi) to sell a 17.5 per cent stake in Hyundai Motor India. The IPO size is pegged at Rs 25,000 crore, the largest ever for the domestic markets.

According to recent news reports, South Korea’s LG, a home appliance major, is exploring options to list domestic LG Electronics India. Reports also suggest that Hindustan Coca-Cola Beverages (HCCB), a bottling company owned by Coca-Cola India, is planning to go public in the country. “There is enough liquidity to absorb new papers at good valuation. MNCs that have substantial business in India might look to list,” said Dharmesh Mehta, managing director and chief executive officer of DAM Capital Advisors.

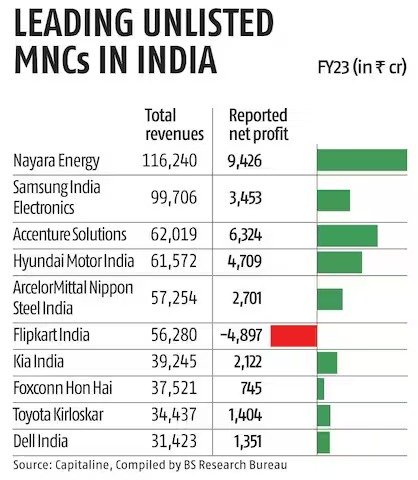

Some of the biggest MNC firms operating in India in terms of revenues are Russia’s Nayara Energy, Samsung India Electronics, ArcelorMittal Nippon Steel, and Toyota Kirloskar Motor.

Market players said the valuations offered in the $5-trillion Indian market were at least 2x-5x higher than those in Korea, Russia, and Europe. “Generally, MNCs don’t prefer to list outside their home market, especially the western MNCs. However, there is a rethink in that approach given the valuation premium in India,” said Pranjal Srivastava, partner (investment banking) at Centrum Capital.

For instance, Tokyo-listed Suzuki Motor trades at a 12-month forward price-to-earnings (P/E) of 11 times, while Maruti Suzuki commands a P/E of 25 times. Similarly, consumer goods giants Hindustan Unilever and Nestlé India command a P/E nearly 3x and 4x that of their parent firms.

While India’s benchmark Nifty index trades at a one-year forward P/E multiple of 22x, several domestically listed MNCs command even greater valuations.

“Across sectors, MNC stocks are trading at better valuations than their domestic counterparts. It makes sense for other MNCs to capitalise on this. If India becomes the third-largest economy, its efforts to create a broader stakeholder ecosystem will help foreign firms win big,” said Ajay Garg, founder of Equirus.

Some of the listed foreign firms or stakeholders have already encashed their stake this year. In February, US-based appliance major Whirlpool divested a 24 per cent stake in Whirlpool of India for Rs 3,881 crore. In March, BAT Plc sold a 3.5 per cent stake in ITC to raise Rs 17,485 crore.

Request a call back

Request a call back