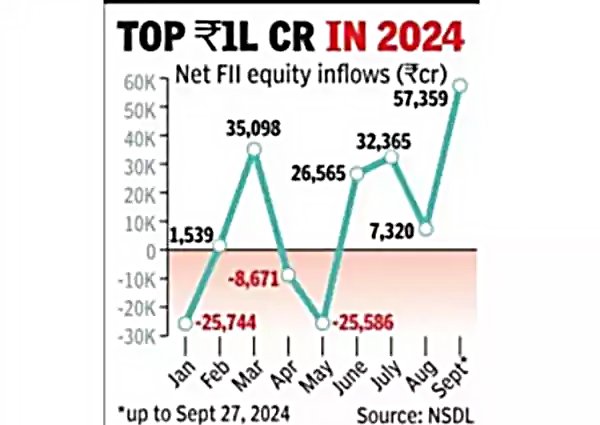

Foreign investors have infused Rs 57,359 crore into Indian equities in September, marking the highest monthly inflow in nine months, largely due to the US Federal Reserve’s rate cut.

This brings foreign portfolio investors' (FPIs) total equity investments in 2024 past Rs 1 lakh crore, according to depository data. FPI inflows are expected to remain strong, bolstered by global interest rate reductions and India's solid economic fundamentals.

However, the Reserve Bank of India's decisions on inflation control and liquidity management will be crucial to sustaining this trend, noted Robin Arya, founder & CEO of research firm GoalFi.

The data reveals that FPIs made a net investment of Rs 57,359 crore in equities as of September 27, with one trading day still to go. This represents the highest net inflow since December 2023, when FPIs invested Rs 66,135 crore. Since June, FPIs have consistently been buyers after withdrawing Rs 34,252 crore in April and May. Overall, FPIs have been net buyers throughout 2024, except in January, April, and May.

Several factors have driven this recent surge in FPI inflows, including the US Fed's rate cut, India's increased weight in global indices, positive growth forecasts, and the rise in large IPOs, said Himanshu Srivastava, associate director of manager research at Morningstar Investment Research India.

Request a call back

Request a call back