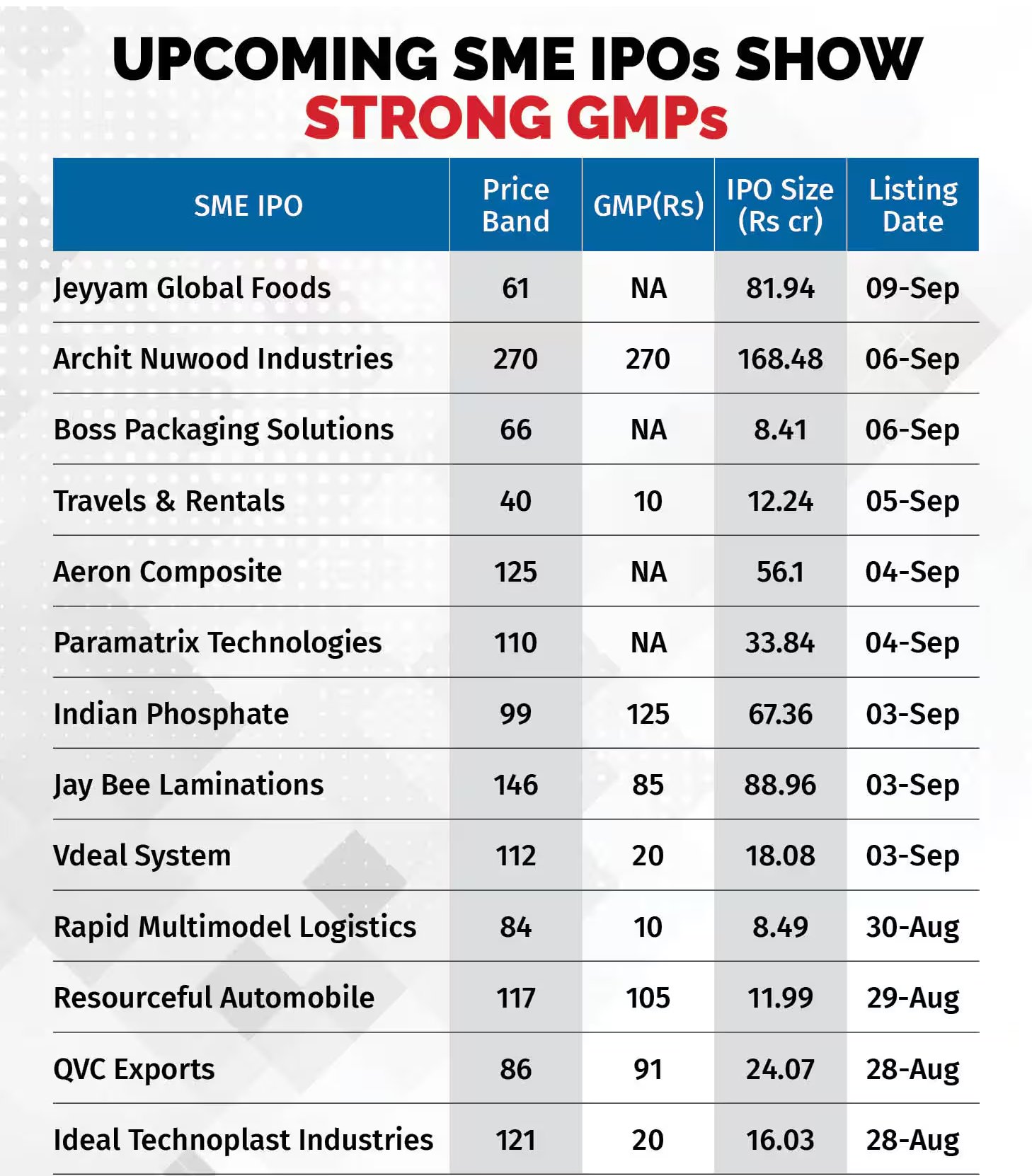

Despite concerns from market participants and regulators about possible overvaluation, the momentum in SME IPOs continues unabated. Currently, 13 SME IPOs are poised to list soon, many with strong grey market premiums (GMPs).

Four of these IPOs have GMPs exceeding 100%, and another four are trading with premiums between 25% and 60%. Five SME IPOs have not yet begun grey market trading, but analysts expect strong premiums when they do.

The high investor interest in SME IPOs is largely due to the strong performance of some recently-listed companies. However, experts warn investors to remain cautious and conduct thorough research. Vinod Nair, Head of Research at Geojit Financial Services, noted that demand for SME IPOs has reached extreme levels, with oversubscriptions driving substantial listing gains and post-listing price increases. He suggests that this overenthusiasm may diminish as the broader market rally stabilizes.

Regarding specific IPOs, OVC Exports, set to list on NSE Emerge on August 28, has a GMP of Rs 91 per share, compared to its price band of Rs 86. Resourceful Automobile, listing on BSE SME on August 29, has a GMP of Rs 105 per share, up from its price band of Rs 117.

Indian Phosphate, listing on NSE SME Emerge on September 3, has a GMP of Rs 125 per share, well above its price band of Rs 99. Archit Nuwood Industries, listing on BSE SME on September 6, is trading at a GMP of Rs 270 per share, aligning with its price band.

Other SMEs with GMPs ranging from 10-90 percent include Ideal Technoplast Industries, Vdeal System, Jay Bee Laminations, and Travels & Rentals. Meanwhile, the GMPs for Jeyyam Global Foods, Boss Packaging Solutions, Aeron Composite, Paramatrix Technologies, and Rapid Multimodal Logistics have not yet opened.

In 2024, SME IPOs have seen a record 173 listings, raising over Rs 5,965 crore, compared to 182 IPOs in 2023 that raised Rs 4,684 crore.

Independent analyst Ajay Bagga pointed out that the SME segment carries minimal market risk due to the relatively small amounts raised compared to overall market liquidity.

He noted that the trend of oversubscription is fueled by the ASBA process, where funds are only deducted upon actual subscription, allowing investors to leverage idle funds with minimal risk and potential gains of up to 100% in GMPs. Bagga, however, cautions against chasing inflated post-listing prices, as this could result in substantial losses.

Request a call back

Request a call back