Strategists predict weak profit growth for companies in the NSE Nifty 50 Index for the quarter ending in June. Citigroup Inc. expects their combined net income to increase by just 2% from the previous year, while Motilal Oswal Securities Ltd. estimates a 4% rise. This is a stark contrast to the previous quarter's growth of over 11%, which exceeded expectations.

Analysts are finding it hard to rationalize an 11% recovery in the Nifty since the June 4 selloff, which was triggered by the ruling party losing its majority in parliament.

The earnings slowdown is attributed to factors such as a severe heatwave, prolonged election activities, and central bank restrictions on unsecured loans, all of which have curbed consumption.

Energy, banking, and commodity sectors are anticipated to have a challenging quarter, negatively impacting the Nifty’s overall performance. Both HDFC Bank Ltd. and Bank of Baroda Ltd. reported a sequential decline in credit growth, indicating that lenders, who have the highest index weighting, are struggling to maintain the rapid growth seen in recent years.

Indian stocks need consistent earnings growth to support their high valuations. Currently, the Nifty trades at over 20 times one-year forward earnings, a 27% premium to its historical average, according to Bloomberg data.

On the positive side, technology companies, which constitute 13% of the Nifty 50, might mitigate the slowdown in banks. Nomura Holdings Inc. recently noted that the sector's slowdown likely hit its lowest point in the June quarter and should not worsen.

Motilal Oswal has upgraded its outlook for software exporters from underweight to overweight. Tata Consultancy Services Ltd. will release its results on Thursday, marking the start of this earnings season, with HCL Technologies Ltd. following on Friday.

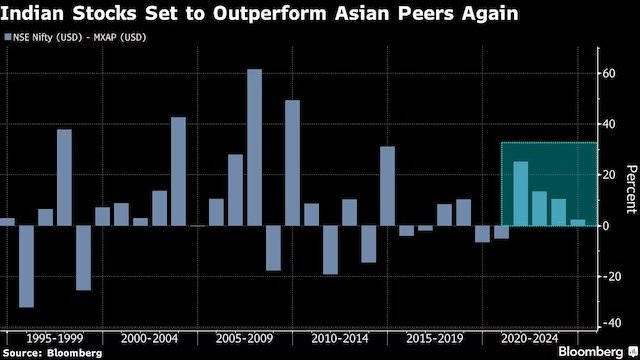

Despite these challenges, Indian stocks are on track to outperform their Asian counterparts for the fourth consecutive year. Strong economic growth, robust local mutual fund buying, and steady earnings have made India a top pick for outperformance in 2024.

The main equity indexes have reached new highs, bolstered by Prime Minister Modi's re-election, which reassured investors of ongoing pro-growth policies. Expectations are that his administration will use a $25 billion central bank dividend to boost consumption and infrastructure spending in the upcoming budget.

"There will be a sustained focus on infrastructure, capex, and manufacturing, which will occupy center stage," wrote Gautam Duggad, head of research at Motilal Oswal, this week.

However, a slow start to the earnings season for the fiscal year ending March 2025 could lead to a period of consolidation for local equities, according to Citigroup.

“I wouldn’t be surprised if earnings growth for this year drops to mid-single digits if the June quarter shows weak demand and margin compression for companies,” said Dhananjay Sinha, co-head of equities at Systematix Group. “It will be challenging to achieve the strong returns investors have been used to.”

Request a call back

Request a call back