Market concentration has continued to grow across India’s major industries, with top players capturing a larger share of the market in the fiscal year 2023-24 (FY24) through organic growth or acquisitions.

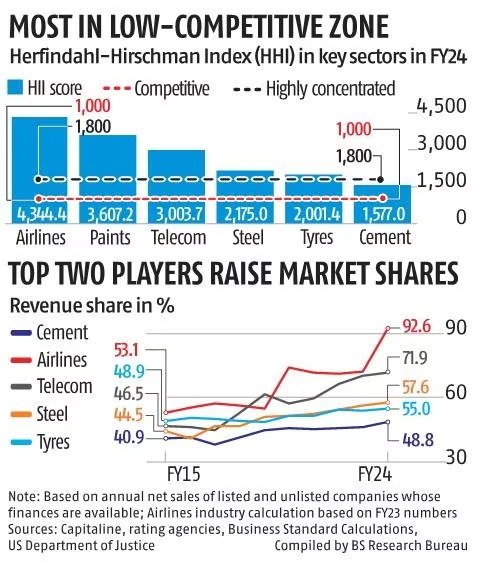

The Herfindahl-Hirschman Index (HHI), which measures market concentration, reached new highs in FY24 in sectors such as telecom, airlines, cement, steel, and tyres. According to a Business Standard analysis, the paints industry was the only one to report a decline in the HHI due to new players like JSW Paints gaining market share.

Market concentration in paints is expected to decrease further with the entry of the AV Birla group.

The data indicates a consistent increase in the revenue share of the top two firms across various industries over the last decade, resulting in higher HHI scores. For instance, in the airlines industry, the revenue share of the top two players rose from 53.1% in FY14 to 92.6% in FY23.

In telecom, it increased from 46.5% in FY15 to 71.9% in FY24, while in steel, it went from 44.5% to 57.6% over the same period. Cement and tyres also showed similar trends, albeit to a lesser extent, leading to higher HHI scores in these industries.

Most industries in India are either highly or moderately concentrated, based on the US Department of Justice's guidelines. An HHI score of 1800 or above indicates a highly concentrated industry, while a score between 1000 and 1800 indicates moderate concentration.

An HHI below 1000 signifies a competitive market.

On this scale, the airline sector in India is the least competitive, with an HHI score of 4400 in FY23. The top two airlines, Interglobe Aviation (Indigo) and the Air India-Vistara combine, controlled 92.6% of the market share in FY23.

Interglobe Aviation reported net sales of ₹54,446.5 crore, while Air India and Tata SIA Airlines (Vistara) reported combined net sales of ₹53,045.6 crore. SpiceJet followed with ₹8,572 crore, and Akasa Air with ₹698.7 crore.

The paints industry had an HHI score of 3607, telecom scored 3004, iron and steel scored 2175, and tyres scored 2001 in FY24. The cement industry was moderately concentrated with a score of 1577.

The HHI is calculated by squaring the market share of each player and summing the results, ranging from near zero to 10000, indicating a monopoly. Analysts attribute the rise in market concentration to the superior profitability of larger firms and recent mergers and acquisitions.

Dhananjay Sinha, co-head of research and equity strategy at Systematix Institutional Equity, noted that larger firms have been more profitable due to their scale and adoption of new technologies, while smaller firms have struggled and either shut down or been acquired.

In a 2013 Brookings paper, economist Viral Acharya highlighted the rising market concentration in India, noting that markups had begun increasing steadily after a period of decline.

This trend was evident in the financial performance of listed companies, with operating margins (excluding banks and financial firms) rising to 17.8% in FY24, up from 15.1% the previous year, nearing the all-time high of 18.1% in FY21 and above the pre-pandemic average of 15.7%.

Request a call back

Request a call back