As Indian benchmark stock indices hit new highs, billionaire banker Uday Kotak emphasizes the need to boost equity supply through new listings and secondary sales. His comments come as the primary market prepares for a surge of IPOs.

Kotak, the founder of Kotak Mahindra Bank, posted on social media platform X (formerly Twitter), highlighting the unprecedented growth of Indian equities during the COVID era and suggesting an increase in equity supply via new listings, growth for listed companies, and secondary sales in low floating stock companies.

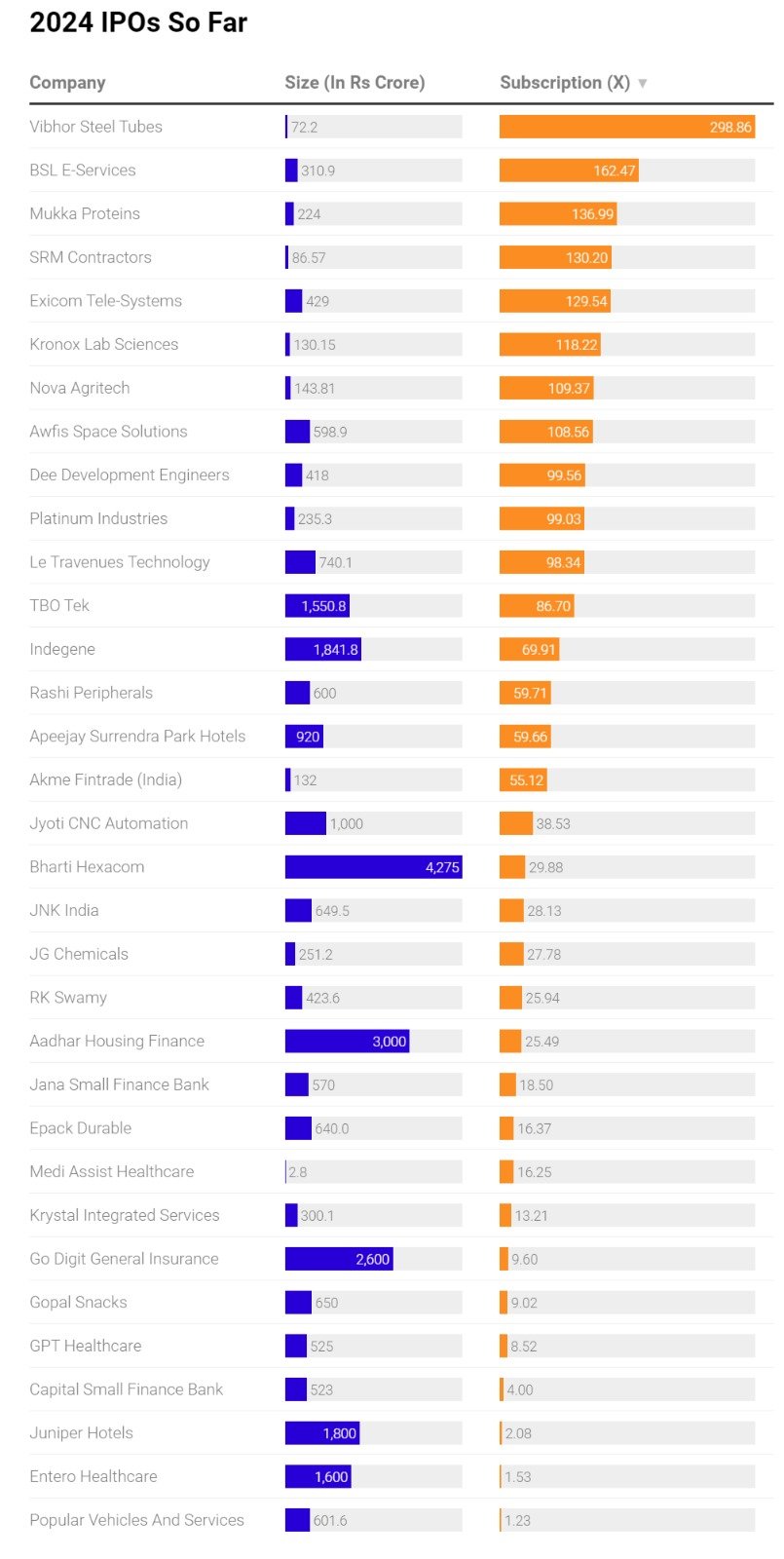

This week, two mainboard segments and seven SMEs will launch their IPOs, including Allied Blenders and Distilleries and Vraj Iron and Steel. In 2024, 33 companies have raised Rs 27,845.38 crore, compared to Rs 49,400 crore raised by 58 companies in 2023.

All 33 IPOs this year have been oversubscribed, with Vibhor Steel Tubes leading with 298.86 times subscriptions, followed by BSL E-Services and Mukka Proteins at 162.47 and 136.99 times, respectively. Oversubscriptions typically result in premium listings due to high demand.

Le Travenues Technology Ltd., the parent company of Ixigo, recently went public, closing at a 78% premium on the NSE and 74% on the BSE. Awfis Space Solutions also saw a premium close of 8.64%.

Ola Electric Mobility is set to list this year, with SEBI's approval. Its IPO includes a fresh issue of Rs 5,500 crore and an offer-for-sale of 9.51 crore equity shares. Additionally, Hyundai Motor's Indian subsidiary plans to raise around $2.5 billion through its upcoming IPO.

Request a call back

Request a call back